Discounted Cash Flow, DCF

The DCF model is a highly sophisticated valuation tool in the investment world, centered on forecasting a company’s future cash flows and discounting them to present value to derive its theoretical intrinsic value. The essence of DCF goes beyond calculation results; it lies in a profound understanding of the company’s business, market trends, industry competition, and economic environment. At an advanced level, DCF is more than just a financial formula—it is a strategic tool that helps investors identify undervalued opportunities in a dynamic market.

The DCF model assumes that a company’s value equals the present value of its future cash flows. Estimating future cash flows is both a quantitative and qualitative process, requiring an in-depth analysis of the company’s profitability model, market demand, competitive advantage, and growth potential. These estimates must be based on strict logic and reliable assumptions, as variations in future cash flows and discount rates significantly impact valuation.

Calculation Steps and Key Insights

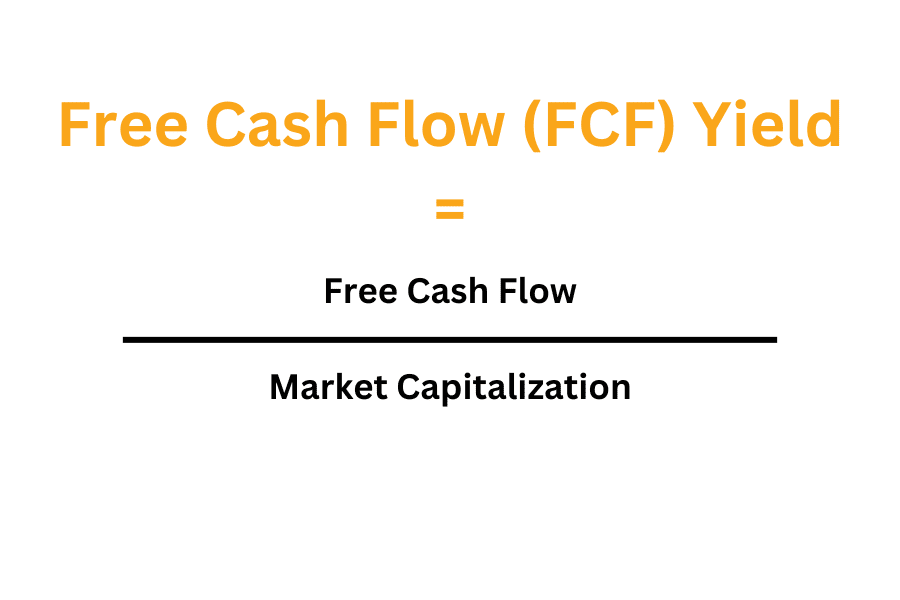

- Forecast Free Cash Flow (FCF)

FCF is the cash available to distribute to shareholders after meeting working capital needs, representing the “residual” wealth a company can generate. When calculating FCF, one must consider future revenue growth, cost controls, capital expenditures, and changes in working capital. For instance, in the case of a technology company with high R&D spending but unstable cash flows, projections should be approached with caution. Future revenue estimates should be based not only on historical data but also on a detailed analysis of innovation capability, market competition, and industry growth.

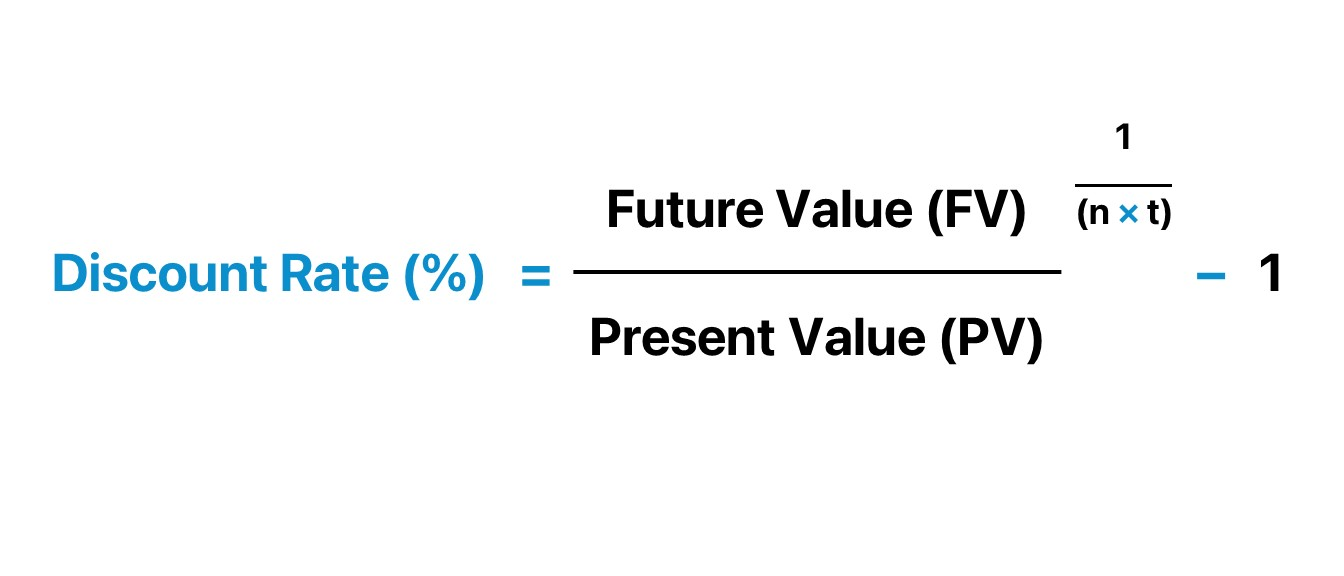

- Determine the Discount Rate

The discount rate is typically represented by the Weighted Average Cost of Capital (WACC) because WACC incorporates both equity and debt costs, reflecting the actual risk within the company’s capital structure. For a large manufacturing company, for example, if it has a high debt ratio and operates in a competitive industry, WACC should be relatively high to account for potential financial and market risks. When calculating WACC, factors such as market interest rates, stock market volatility, and industry-specific risks should be considered, especially during economic fluctuations, as changes in the discount rate directly affect the company’s DCF valuation.

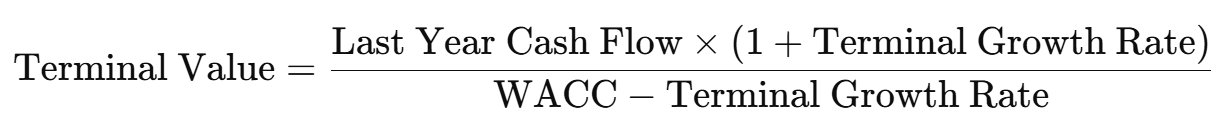

- Calculate Terminal Value

Terminal value represents the company’s worth at the end of the projection period, usually calculated using the “perpetual growth model” or “exit multiple method.” The perpetual growth model is suitable for companies with stable growth, while the exit multiple method is commonly used for high-growth companies. The accuracy of terminal value depends on a long-term growth potential analysis—for example, a medical technology company might benefit from sustained growth due to technological advancements, but selecting a reasonable growth rate is essential to avoid overestimating terminal value.

Case Study: Apple’s DCF Valuation

Assume we are conducting a DCF valuation for Apple. Suppose its free cash flow is $10 billion, with an expected annual growth rate of 5% over the next five years. Assume a WACC of 8% and a terminal growth rate of 2%.

- Free Cash Flow Forecast

Assume Apple’s projected free cash flows for the next five years are $10.5 billion, $11.03 billion, $11.58 billion, $12.16 billion, and $12.76 billion.

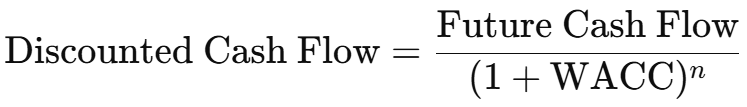

- Discounted Cash Flow

The discounted cash flow can be calculated using the following formula:

where nnn is the time in year nnn.

- Calculate Terminal Value

The final DCF valuation result represents Apple’s theoretical value.

Chart Interpretation

Through graphical representation, we can visually demonstrate the process of forecasting and discounting cash flows. The declining curve of discounted cash flows reflects the discounting effect on future cash flows, while the terminal value often comprises a significant portion of the DCF valuation, highlighting its importance in the overall valuation.

Sensitivity Analysis: Impact of Variables on Valuation

- Applicability of the DCF Model

DCF is best suited for companies with stable cash flows, but for high-growth or high-uncertainty companies (such as emerging technology firms), DCF assumptions are difficult to make accurately. Over-relying on DCF valuations may lead to overestimating these companies’ value.

- Limitations of the Model and Sensitivity to Assumptions

One major limitation of the DCF model is its sensitivity to assumptions. Small changes in growth rates or discount rates can lead to significant shifts in valuation. Therefore, sensitivity and scenario analyses should be incorporated when using DCF to evaluate valuation changes under various conditions, ensuring the model’s robustness.

- Practical Adjustments

In practice, investors typically use multiple valuation methods (such as P/E, EV/EBITDA, etc.) to verify the reasonableness of DCF valuations, avoiding bias from relying on a single model. Using DCF as a basis and incorporating market multiples and industry comparisons can yield more comprehensive investment decisions.

Advanced Applications of DCF in Different Market Conditions

- Bull Markets and Overvaluation Risk with DCF

In bull markets, investor sentiment is often more optimistic, leading to unrealistic market growth expectations. Using the DCF model under these circumstances can easily overestimate future cash flow growth. In such cases, investors need to make more conservative adjustments to assumptions, adopting a “conservative growth rate” rather than the high growth rate expected by the market to ensure objective valuation.

- Bear Markets and Undervaluation Risk with DCF

Conversely, in bear markets, the market outlook is often overly pessimistic, making the projected cash flows appear overly conservative and undervaluing the company. In this scenario, scenario analysis can be used to set different growth rate scenarios (optimistic, neutral, and pessimistic) and weigh their results to more accurately reflect the company's intrinsic value. These adjustments are particularly important for value investors, as bear markets may offer opportunities to buy quality assets at a discount, and the DCF model helps investors rationally assess value during market lows.

- DCF Strategy in a High-Inflation Environment

In a high-inflation environment, the discount rate (WACC) is affected by rising interest rates, significantly reducing the present value of future cash flows. In this case, traditional DCF models may significantly undervalue the company's intrinsic value. A response strategy includes reducing the growth rate forecast for the cash flow projection period to reflect inflationary pressures and making conservative adjustments to the terminal growth rate. Additionally, cash flows can be adjusted for inflation according to industry characteristics; for fast-growing tech companies, inflation may have a relatively minor impact.

Investor Psychology and DCF’s Psychological Pitfalls

- Impact of “Confirmation Bias”

Investors often set DCF model assumptions based on their existing biases, leading to “confirmation bias.” For instance, growth-oriented investors may adopt a higher growth rate or lower discount rate when forecasting a tech company’s DCF to reinforce their confidence in growth potential. This can lead to a discrepancy between the model results and actual conditions. Thus, when setting model parameters, investors should be careful to avoid emotional judgments and base assumptions on actual data and rational analysis.

- Challenges of “Anchoring Effect”

Investors are often influenced by a specific valuation or target price, adjusting model assumptions to approach this valuation—a phenomenon known as the “anchoring effect.” In practice, investors should regard the valuation range as the model’s output rather than using a specific price as an input condition. This “reverse thinking” helps improve the objectivity of the DCF model.

- Avoiding the Risk of “Over-Reliance on a Single Model”

Many investors rely too heavily on the DCF result, ignoring other valuation methods and market references. To avoid this risk, investors should complement the DCF outcome with other models (such as relative valuation), verifying the DCF result’s validity from multiple perspectives.

DCF Strategy Adjustments in Different Economic Cycles

- DCF Strategy in Economic Expansion

During economic expansion, companies typically experience growth, and cash flow and revenue expectations are generally optimistic. In this case, moderately increasing the cash flow growth rate and controlling the discount rate can reflect the company's growth potential in expansion. However, adjustments should be cautious and not overly high to avoid overly optimistic valuations.

- DCF Strategy in Economic Downturn

During an economic downturn, cash flows may decrease, and the discount rate may increase. To adapt to this environment, the DCF model should lower future cash flow growth forecasts to reflect macroeconomic uncertainty and increase the discount rate to cover market risks. In this environment, the DCF model can help identify quality stocks during market downturns for long-term investment positioning.

- DCF Strategy in Economic Recovery

During economic recovery, the company’s growth potential gradually releases, and the DCF model can moderately increase the growth rate to capture this rebound trend. For cyclical companies, in particular, the recovery period may bring substantial cash flow growth, and sensitivity analysis can evaluate the impact of different growth rates and discount rates on valuation.

Extended Example: DCF for Cyclical Companies

For a typical cyclical company, such as an airline, in an expansion phase, its revenue significantly grows with increased consumer demand, allowing DCF to use a higher cash flow growth rate. However, during an economic downturn, airline revenues may drastically drop so the DCF model should reflect the volatility in cash flows to ensure a realistic valuation. Valuing cyclical companies with DCF requires a deep understanding of economic cycles, along with the use of scenario analysis and other tools to account for different economic conditions.

Unique Insights and Final Thoughts

The DCF model is essentially a “value discovery tool” that enables investors to find undervalued, high-quality companies amid market fluctuations through rational assumptions and in-depth analysis. However, the DCF model’s output heavily depends on the assumptions made, so investors must remain rational and vigilant, avoiding the illusion of “false precision.” In real-world investing, DCF is not just a quantitative result but a qualitative extension of thinking—a foundation for long-term investment decisions based on profound insights into a company’s value. This rational, cautious, and multi-dimensional thinking approach is the core investment logic that seasoned traders should maintain when applying the DCF model.

1. Sensitivity Analysis: Exploring the Impact of Key Variables

Within the DCF model, key assumptions like growth rate, discount rate, and terminal growth rate directly affect a company’s valuation. Sensitivity analysis helps traders understand the impact of changes in these assumptions, revealing how sensitive the valuation is to each variable.

Practical Method:

- Selecting Key Variables: Typically, growth rate and discount rate are the most sensitive parameters, so set various increments to observe how valuation shifts.

- Creating Tables or Charts: Divide growth rate and discount rate into ranges, such as 0%-10% variations, and calculate the DCF valuation under each combination. Charts can visually represent the sensitivity of valuation to these variables.

For example, assume a tech company’s growth rate fluctuates between 2%-5%, while the discount rate varies between 7%-10%. A chart showing DCF valuation under different combinations can highlight where the model is most sensitive, helping traders quickly adjust assumptions under varying market scenarios for more accurate valuations.

Practical Significance:

Sensitivity analysis highlights which assumptions, like growth or discount rate changes, traders should prioritize in their investment decisions. For industries with high volatility, such as technology or energy, sensitivity analysis helps forecast investment risk under different macroeconomic conditions, making it an essential risk management tool for professional traders.

2. Scenario Analysis: Building Multiple Market Assumptions

Scenario analysis constructs different market and operational assumptions, evaluating DCF valuation changes under these assumptions. Unlike sensitivity analysis, scenario analysis examines multiple variables simultaneously, creating diverse “scenarios” to simulate real market variability.

Steps:

- Set Scenario Types: For example, “Optimistic,” “Neutral,” and “Pessimistic” scenarios, each reflecting different market growth expectations, competitive environments, and operating costs.

- Adjust DCF Model Parameters: Increase cash flow growth and reduce discount rate in optimistic scenarios; reverse these in pessimistic ones.

- Evaluate Results: Each scenario yields a distinct DCF valuation, forming a “valuation range” that helps investors gauge realistic value.

For instance, with an electric vehicle company, the optimistic scenario may assume substantial government subsidies and tax cuts, while the pessimistic scenario may assume rising energy costs and weak demand. DCF will yield a different valuation range under each scenario.

Practical Significance:

Scenario analysis helps traders navigate complex markets, particularly when uncertainty is high, by providing multi-scenario valuation estimates to mitigate the risk of relying on a single valuation. This method is especially crucial for traders in cyclical industries, where companies are significantly affected by economic cycles and policy changes.

3. Monte Carlo Simulation: Quantifying Uncertainty

Monte Carlo simulation is a more refined valuation tool that generates multiple random combinations of key assumptions, providing a comprehensive distribution of DCF valuations. This method offers flexibility, particularly in cases with highly uncertain future cash flows.

Process:

- Define Variables’ Distribution: Assume growth rate fluctuates between 2%-5%, while the discount rate ranges from 8%-10%, assigning each a probability distribution (e.g., normal or uniform distribution).

- Simulate Data Generation: Use a random number generator to produce numerous variable combinations, typically simulating 1,000-10,000 times.

- Calculate DCF Valuation Distribution: Plug each combination into the DCF model to generate a valuation distribution.

Example:

For a company with a growth rate normally distributed around 3% with a 0.5% standard deviation, and a discount rate uniformly distributed between 8%-10%, running 1,000 simulations yields a probability distribution of DCF valuations. This provides traders with a range of valuations under different probabilities, optimizing risk management.

Practical Significance:

Monte Carlo simulation offers traders a tool to quantify uncertainty, allowing for an objective understanding of the risk-return balance in investment decisions. This approach is often used in venture capital or private equity, where companies face high growth potential and risk.

Unique Insight: Integrating Industry Traits and Risk Preferences in DCF Valuation

In practice, DCF results serve not merely as a final valuation but as a support tool for investment logic. Traders should approach DCF with independent thinking in these areas:

- Consider Industry Characteristics: Different industries and companies have unique DCF applicability. For cyclical industries, a heavier emphasis on sensitivity and scenario analysis may be warranted; for tech-driven companies, accuracy in growth and terminal assumptions is particularly important.

- Adjust Assumptions Dynamically: As markets change, traders should adjust DCF parameters, such as updating the discount rate when interest rates fluctuate or policy shifts occur. Dynamic adjustment enables the DCF model to remain adaptable to market conditions.

- Risk Preferences in Valuation Models: Different risk appetites among investors influence DCF assumptions. Risk-seeking investors may opt for lower discount rates or higher growth assumptions, while conservative investors prefer cautious valuation assumptions. Traders should adjust DCF parameters according to investors’ risk preferences.

Conclusion

The DCF model provides traders with a framework for understanding a company’s value through cash flow quantification. However, the true mastery of DCF lies in comprehending how market fluctuations affect assumptions, alongside the application of advanced tools like sensitivity analysis, scenario analysis, and Monte Carlo simulation to discover value amidst uncertainty. For seasoned traders, DCF is more than a static valuation model; it is a dynamic analytical tool and foundational support system for investment decisions. By combining market insights, industry analysis, and risk management strategies, traders can make forward-looking investment decisions in complex markets.